The U.S. Tariff Shockwave Impact on Canada: A Deep Dive into Trade, Economy, and Policy Response

In a move that has sent ripples across the border, the United States has imposed new, sweeping tariffs on foreign goods, and Canada, its major trading partner, is experiencing its largest trade disruption in nearly a century. This upshot has plagued economic ties between the two nations, while raising questions about the future of international trade norms and the underlying principles.

This month, we break down the implications of the U.S. tariffs on Canada’s economy, trade relations, and businesses. Explore what's changing, the economic consequences, and Canada’s response to this major trade shock wave.

U.S. Tariffs on Canadian Goods—What’s the Latest?

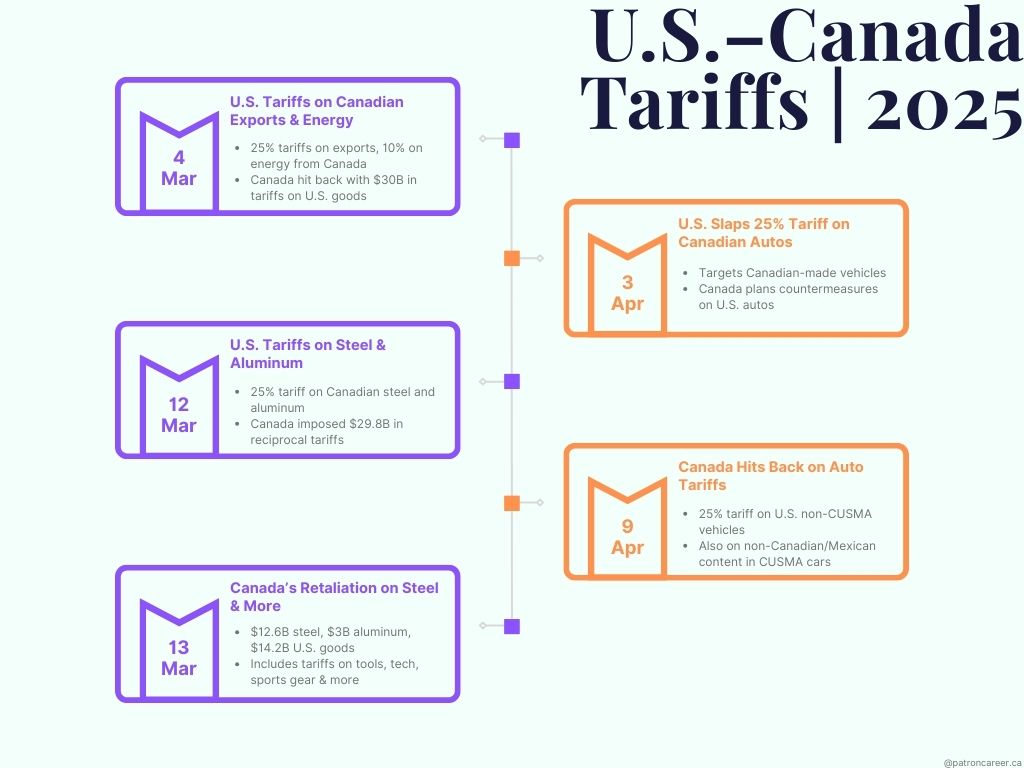

A tariff is a tax placed by a country on goods imported from other countries. The U.S., on March 4, 2025, imposed new tariffs on Canadian goods, disrupting the longstanding trade relations between these two allies. The initial tariff announcement came on February 1, 2025, but its implementation was postponed to March 4, 2025. The scope of these tariffs is widespread, ranging from energy exports to an array of agricultural and consumer goods. Additionally, by March 12 and April 3, respectively, new tariffs targeting Canadian steel and aluminum products and Canadian automobiles were added.

What Goods Are Affected by the U.S. Tariffs?

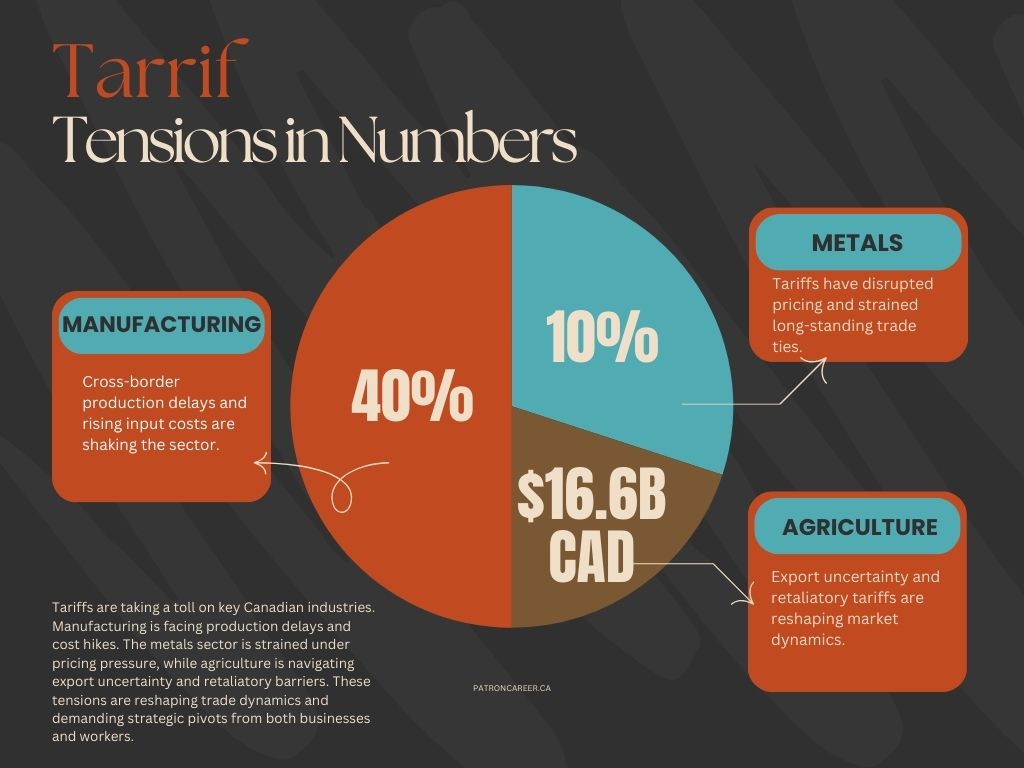

The Tariffs Impact a Wide Range of Canadian Exports:

- 25% on most Canadian goods

- 10% on energy product exports from Canada

- 25% specifically on steel and aluminum (as of March 12)

Key Affected Sectors:

Here are the key industries where the impact is most visible:

- Manufacturing & Automotive

- Steel and Aluminum

- Oil & Energy

- Agriculture & Food Processing (maple syrup, dairy, grains)

- Consumer goods (household appliances, packaged foods)

These sectors will be hit hardest by President Trump's tariff surge, creating logistical, pricing, and export hurdles for Canadian industries that rely heavily on the U.S. market.

The Rationale Behind Imposing These Tariffs

Reportedly, the U.S. blanket tariffs were imposed under the International Emergency Economic Powers Act (IEEPA). The U.S. administration has justified these tariffs on the grounds of battling the extraordinary threat to U.S. national security and economic protection. It is conversely argued that these tariffs will promote U.S. manufacturing and protect jobs, but inadvertently, the world economy has been turned upside down by this chaos.

Critics argue that the ulterior motive is to increase domestic manufacturing competitiveness and reduce trade deficits, even if it's at the detriment of long- standing trade relationships.

MFN-WTO Violation: Is the U.S. Breaking Global Trade Rules?

Certainly, and Canada is not staying silent on the matter.

The state of play is that the U.S. has brazenly abandoned the World Trade Organization’s (WTO) rules, which are the Most-Favoured Nation (MFN) principle, which ensures equal trading among all the member nations. Canada has formally challenged the violation by instating a WTO dispute complaint, citing contraventions to age-old norms of global trade, commerce, and its unprecedented economic harm.

A Two-Way Street: Canada’s Retaliatory Tariffs and WTO Challenges

As a countermeasure to U.S. tariffs, Canada has unveiled its most comprehensive tariff package targeting U.S. goods to protect Canadian consumers, businesses, and workers. Effective March 4, 2025, Canada imposed 25% tariffs on $30 billion worth of U.S. imports, including items such as orange juice, peanut butter, and household appliances. Furthermore, Canada has signaled its readiness to escalate these measures, proposing additional tariffs on $125 billion worth of U.S. goods, pending public consultation.

On March 13, Canada specifically responded to the U.S. steel and aluminum tariffs by implementing reciprocal 25% tariffs on $29.8 billion worth of U.S. goods, including $12.6 billion in steel products, $3 billion in aluminum goods, and $14.2 billion in various other items such as tools, sports equipment, and display monitors. Canada has adopted a vigorous strategy by imposing 25% tariffs on non-CUSMA (Canada- United States-Mexico Agreement) compliant vehicles as a measure to defend its economy on the world stage.

While the counter-tariffs are well-intended to level the playing field, Canada’s tit-for- tat action may intensify tensions and distort the businesses and consumers that heavily rely on U.S. imports.

How the Tariffs Are Impacting Canadian Businesses and Consumers

Canadian businesses and consumers have been caught in a web of economic anxiety and doubt. They are certainly feeling the pinch as a result of sweeping tariffs.

The unjustified trade turbulence has brought to light multifaceted impacts:

1. Exporters Face Mounting Costs

Canadian exporters, especially of steel, aluminum, and agriculture, now face steep tariffs, making their goods less competitive in the U.S. This threatens both market access and long-term supply chain stability, and ultimately puts the profit margin under pressure.

2. Consumers Brace for Price Hikes

As the tariffs go up, retailers and importers are passing on costs to consumers. From groceries to household appliances, Canadians are seeing noticeable price increases.

3. Manufacturers and SMEs Hit Hard

Small and mid-sized enterprises (SMEs) are particularly susceptible. Without the financial buffers of large corporations, many SMEs are struggling to adjust pricing, manage inventory, or shift markets.

4. Housing Market and Economic Confidence Slide

According to the Canadian Real Estate Association (CREA):

- Home sales dropped 4.8% in March alone

- Prices fell by 3.7% year-over-year

- CREA attributed the slump largely to “uncertainty over tariffs,” notably those from the U.S.

CREA attributed the slump largely to “uncertainty over tariffs,” notably those from the U.S.

Border-reliant industries face financial distress, and hiring freezes, layoffs or job losses may follow, ultimately affecting workers’ livelihood.

What is the Canadian Government Doing to Help?

The Canadian government has introduced several measures to cushion the blow and protect affected businesses and workers.

Offering Financial Support for Business Owners:

- The Business Development Bank of Canada (BDC) has announced $500 million in working capital, low-interest loans to viable businesses.

- Export Development Canada (EDC) to work closely with the Government of Canada and support affected exporters. It has launched a $5 billion trade impact program.

Aid for Workers:

- For workers facing slowdown, the duration of the Employment Insurance (EI) Work-Sharing Program has been enhanced.

- More flexible terms for businesses to retain staff during downturns.

Support for Agriculture:

- On the lines of the trade disruption customer support program, the Farm Credit Canada (FCC) is coming to rescue the farmers by giving $1 billion in funding.

- Options for loan deferrals, credit expansion, and debt restructuring.

The Canadian government is taking stringent measures to mitigate the fallout and stabilize sectors under pressure.

Long-Term Implications of U.S. Tariffs on Canada

The current trade tensions have raised significant questions about Canada’s future:

• Will Canada diversify its trade partnerships?

It is possible. Canada’s increased focus on Europe, Asia-Pacific (CTPP), and Latin America may become a necessary strategy.

• What about the USMCA?

Trade experts warn that these sweeping tariff actions undermine the spirit of the USMCA and could trigger renegotiations.

• Can Canada remain competitive globally?

On the trade front, Canada can navigate this tariff chaos depending on how swiftly businesses can innovate, pilot, and scale new export markets.

The Road Ahead: A Test of Resilience and Diplomacy

The current state of affairs presents a significant challenge, but not an insurmountable one. The path forward demands innovative thinking, along with an agile and resilient approach in the face of substantial economic adversity.

The U.S. tariff story is still unfolding. However, businesses and workers must stay agile and informed to navigate the tides of change.

Patron Career Staffing: Your Ally in a Shifting Trade Landscape

U.S. tariffs signal that it's time for our workforce and businesses to turn this turmoil into opportunity. The good news? You don't have to navigate it alone. Let Patron Career Staffing be your compass, even in tough times.

Reach out to us at patroncareer.ca