Machine Operators

25 October, 2022

Patron Career Staffing firmly believes in adopting a tailored approach to meet temporary and permanent recruitment needs. We safeguard the interest of our clients by finding such workers who are knowledgeable and reliable.

About UsNeed help? Make a Call

32 Dundas Street East Unit A, L5A1W2

Designing and evaluating an employee benefits program is quite similar to finding a needle in a haystack. Only a well-thought-out benefits plan can save time, travail, and costs for the employer while also aligning the employer’s goals and the employee’s job needs.

If you’re keen on learning potent ways to manage your existing benefits program, or if your company is finding it hard to put together an instrumental employee benefits package in place, keep reading this article to understand why you need an effective benefits plan to sustain and attract new employees, more than ever!

It is without a doubt important for companies to allocate their time and costs to devise a competitive employee benefits program. But understanding the relationship between employees and benefits is equally important too.

Benefits, sometimes known as Fringe Benefits, are non-monetary perquisites and incentives that play a vital role in employee retention and talent attraction. Such compensation is decided based on age, gender, and the number of employees working in the company. It is a splendid way to improve the employee engagement rate of the organization.

This indirect form of cash compensation can be rendered to the employees in the form of health insurance plans, paid leaves, retirement benefits, disability insurance, flexible working hours, employee association memberships, and financial wellness programs are among the very best options appreciated by all employees.

The key point of difference here is that such a benefits package does not form part of the employee's base wages or base salaries. It is something given to employees apart from direct pay that highlights the organizational values and shows that the employees are the very assets of the organization and that they are well taken care of.

Regardless of the opinion, we believe that compensation and benefits go hand in hand. If one falls the other also collapses and so does the organization.

To save oneself from the detrimental repercussions of an erroneous benefits pack, do not ever think of this package as a financial burden. It is only natural for a company’s HR professionals to oversee the following as the most pressing concerns (internal) in their organization’s success:

All the above-stated problems have one solution- a well-designed and maintained benefits plan for employees. We refer to employee benefits programs as an area of hidden ROI. Essentially because it caters to vast employer concerns and even improves the brand image as well.

Think it yourself, a happier and more motivated workforce will bring in more revenue for your company, thus revamping your competitive advantage in the market.

Related- Employee Retention Strategies to Look for in 2022

The answer to both of these questions lies in realizing that acing employee experience and ROI doesn’t happen overnight. It requires strenuous deliberation and persistent efforts to entice and coordinate a benefits plan.

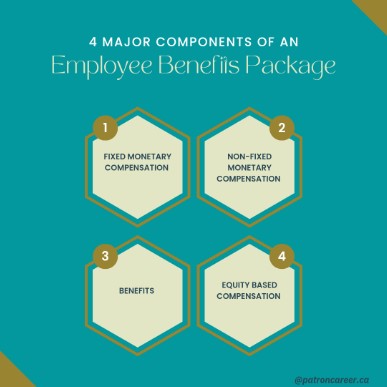

To get off to a flying start, we have compiled 4 most crucial criteria for employees to follow while curating an employee's benefits package:

1. Recognize what goal you want to fulfil

Before compiling various benefits scams, you ought to know what you want to accomplish through this very means. This step will provide you with not the specific benefits but a brief overview of what all benefits will boost and reflect our company image to the employees. It is only best to identify such benefits that will favor your organizational objectives too.

For instance, some employers may choose to invest in benefits that are 'employer- oriented’ such as a pension plan or a healthcare marketplace plan. While others may incorporate ‘employee-oriented’ and employee-selected benefits packages, such as a Flexible Spending Account (FSA).

2. Allocate a budget

Equally important is deciding on a budget constraint before developing a benefits program. It will guide you to choose among various alternatives without burning excess money. It is only ideal for companies to hire a professional accountant or such expert help to advance this process.

Knowing your financial situation week in advance is prudent, especially for small and medium-sized companies, to avoid ending up in a financial burden because of this.

If you already have a current benefits plan in operation, you can examine it thoroughly by analyzing the gap between current benefits costs and projected costs you’re likely to incur. You can thus make a budget spreadsheet to lay out your financial data concerning the benefits scheme.

3. Be mindful of any legal obligations

Acknowledge any benefits you’re legally mandated to provide your employees- such as a pension, parental leaves, workers' compensation, PTO, etc.

Canada’s Scenario- mandatory benefits may vary from state to state, but in general 2 weeks of paid vacation leave are offered to employees after 12 months of tenure.

Other lists of benefits protected by Canadian Federal Labor Standards are listed below:

Failure in abiding by government laws on benefits can attract hefty penalties for companies, so always be aware of the standards that are in place.

4. Include valuable benefits

Simply going on formulating a list of benefits that fit within your budget, will not ameliorate employee engagement. You need to be careful and design the right benefits plan that suits your employees. It is not only about your needs; it is about your employees too. You can always approach your employees directly and ask for their wishes and needs regarding benefits. Never opt for a “one size fits all” scheme. Your benefits program must stand tall on the needs and wants of your workforce, for it to be successful. Conduct research and survey employees if you want to provide them with the benefits they want.

Our tip- put yourself in the employee's shoes, and ask yourself - would you choose a job with plausible benefits or a job that offers a 40% high salary but no added benefits? This way you’ll get the hang of designing a benefits program.

Young job hunters and new employees often lack awareness of assessing the employer benefits offered to them, before accepting a job. We’ve compiled a few important factors you need to consider while appraising a job offer: -

1. HEALTHCARE INSURANCE

First things first, get a general sense of the medical insurance your prospective employer is willing to offer you. Whether they have dental, paramedical, or vision insurance, or inquire about what percentage you pay and what the employer pays to cover the healthcare costs. You may also want to check if the package offers you an FSA and other wellness stipends

2. PTO

Gauge all vacation and sick days’ benefits, to maintain a work-life balance. Some companies’ top-up government-paid leaves with their own leave coverage for employee benefits.

3. KNOW HOW BONUSES WORK

See the real picture and avoid any backlash by simply doing through the company's policy on bonuses- the what, how, and when of the benefits package. Understand how the bonuses are structured, are they-

4. CALCULATE THE MONETARY VALUE OF OTHER PERQUISITES, TOO

Perks like compassionate care leaves, child-care facilities, gym memberships, free food, health clubs, and other stipends must be well thought of because they are indeed worth thousands of dollars.

5. STUDENT LOAN FORGIVENESS

Some Canadian employers, also help shoulder their young talent’s student loan debt burden. Readily inquire the employer if such a benefit is available.

6. EMPLOYEE ASSISTANCE PROGRAMS (EAPs)

They are additional benefits to providing short-term assistance for general mental health support to the employees.

Do not just fixate on salary alone. Get a true sense of what your prospective employer is offering you above the average salary.