Why Employees Depart

21 July, 2023

Patron Career Staffing firmly believes in adopting a tailored approach to meet temporary and permanent recruitment needs. We safeguard the interest of our clients by finding such workers who are knowledgeable and reliable.

About UsNeed help? Make a Call

32 Dundas Street East Unit A, L5A1W2

In today's fast-paced and demanding work environment, the well-being of employees extends beyond just physical and mental health. Financial wellness has emerged as a crucial aspect of overall well-being, affecting an individual's stress levels, job satisfaction, and productivity. As a leading staffing company in Ontario, Canada, PCS not only offers a wide range of staffing services but also recognizes the significance of financial wellness for its employees. In this blog, we delve into the meaning of financial well-being and payroll, highlight their importance, highlighting their importance in promoting employees' financial wellness and the methods through which payroll can make a positive impact.

Understanding Financial Well-being and Payroll

Financial well-being refers to the state of being in control of one's financial situation and being able to effectively manage both present and future financial needs. It goes beyond just earning a salary; it encompasses budgeting, saving, investing, and having access to financial tools and resources to achieve financial goals.

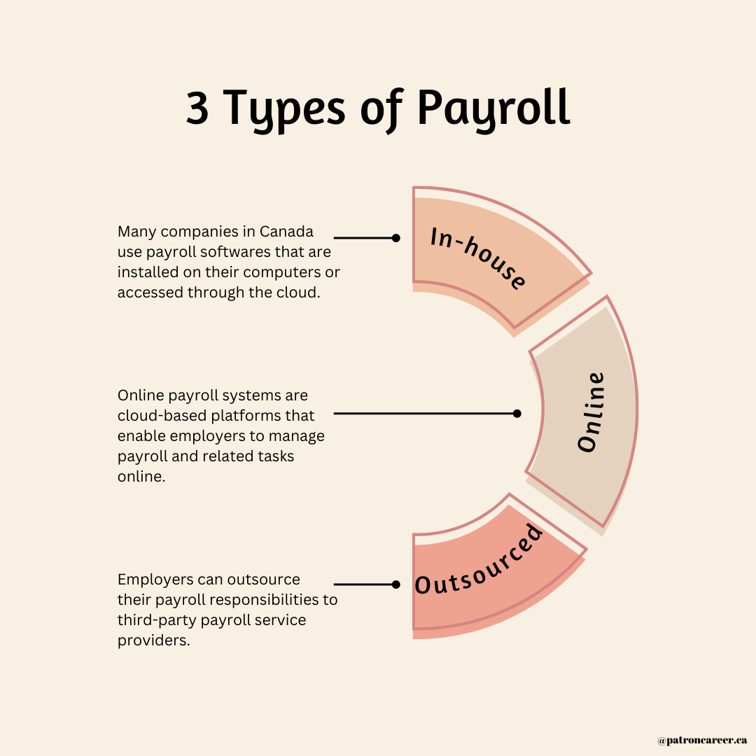

Payroll, on the other hand, is the process by which employees are compensated for their work. It includes calculating wages, deducting taxes and other withholdings, and ensuring timely and accurate payment to the employees.

Also See: Driving Employee Engagement through Learning and Development

The Importance of Financial Well-being and Payroll

Financial well-being directly impacts an employee's overall happiness and job satisfaction. When employees feel financially secure, they can focus better on their roles and responsibilities, leading to increased productivity and reduced stress levels. Financially stable employees are also less likely to be distracted by financial worries, resulting in improved workplace morale and better retention rates.

For PCS, recognizing the importance of financial well-being aligns with its commitment to fostering a positive and supportive work environment, ultimately benefiting both the company and its clients.

The Benefits of Financial Well-being

1. Employee Happiness and Productivity

Financial stress can significantly impact an employee's happiness and job satisfaction. When employees are burdened with financial worries, they may become less engaged and productive at work. On the other hand, financially secure employees can focus better on their tasks and contribute more effectively to their roles.

2. Employee Retention

This is one of the most common reasons behind employees quitting on you. Employees are Employers who prioritize financial wellness through their payroll offerings are more likely to retain valuable talent. Employees are more inclined to stay with an employer that supports their financial goals and provides resources to enhance their financial knowledge.

3. Reduced Absenteeism

Financial stress can lead to health problems and increased absenteeism. By promoting financial wellness, employers can help reduce the financial stress burden on their employees, leading to healthier and more present employees.

Related- Understanding the Mental and Overall Well-Being of Employees

Role of Payroll in Boosting Financial Well-being of Employees

1. Timely and Accurate Payments

Payroll plays a crucial role in ensuring that employees receive their wages on time and without errors. Timely paychecks allow employees to meet their financial obligations promptly, reducing the risk of incurring late fees or penalties. Accurate payments also build trust between the employer and employees, fostering a positive work environment.

2. Financial Education and Resources

Payroll can be leveraged to promote financial well-being by offering access to financial education programs and resources. This can include workshops, webinars, or online courses on budgeting, saving, investing, and managing debt. Equipping employees with financial knowledge empower them to make informed decisions and take control of their financial futures.

3. Employee Benefits and Retirement Plans

Payroll can incorporate employee benefits such as retirement plans, health insurance, and flexible spending accounts. These benefits provide employees with financial security and support in times of need, encouraging them to focus on their long-term financial goals and overall well-being.

4. Flexible Pay Options

Offering flexible pay options, such as direct deposit or split payments, allows employees to manage their finances more effectively. This flexibility enables them to allocate funds to savings, investments, or other financial priorities directly, improving their financial planning capabilities.

5. Employee Assistance Programs (EAPs)

Payroll can facilitate the implementation of Employee Assistance Programs that incorporate financial counselling and support services. EAPs can offer confidential financial advice, debt management assistance, and resources to employees facing financial challenges. This support can help employees navigate difficult financial situations and reduce stress.

Pivotal role of Effective Payroll Management

1. Reduced Financial Stress

Timely and accurate payroll processes help alleviate financial stress for employees. Knowing that they can rely on consistent paychecks allows employees to focus on their work without worrying about their immediate financial needs.

2. Improved Employee Productivity and Morale

Financially secure employees are more likely to be motivated and productive at work. By offering financial education and benefits, payroll contributes to a positive work environment, enhancing employee morale and engagement.

3. Enhanced Employee Retention

Companies that prioritize employee financial well-being through payroll solutions are more likely to retain top talent. Employees feel valued when their financial needs are addressed, leading to increased loyalty and decreased turnover rates.

4. Better Financial Planning

By providing access to financial resources and benefits, payroll enables employees to plan for their financial future more effectively. This includes setting financial goals, saving for emergencies, and preparing for retirement.

5. Overall Workplace Well-being

When employees experience improved financial well-being, the overall workplace atmosphere is positively impacted. A financially secure workforce tends to be more focused, cooperative, and supportive of each other, fostering a culture of well-being and unity within the organization.

Closing Remark

Promoting financial wellness among employees is a win-win situation for both employers and their workforce. Employers that prioritize financial wellness through their payroll offerings can expect to see improved employee satisfaction, productivity, and retention rates. By offering timely and accurate paychecks, providing financial education and resources, and implementing flexible pay options and beneficial packages, employers can make a positive impact on their employees' financial well-being. Ultimately, a financially healthy workforce leads to a more engaged, productive, and loyal team, benefiting the organization as a whole.